If you heard the term “Greeks” before when it came to options and decided not to investigate any further as to what they are, this is your chance to fill that knowledge gap. This post will help you understand the different factors that affect the price of an options contract and will make you more informed as to which options to trade and when to trade them.

What are Greeks?

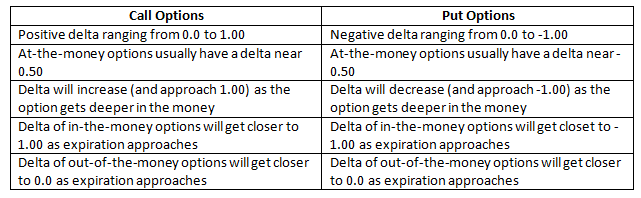

Greeks – Delta, Gamma, Theta, Vega, and Rho - measure the different factors that affect the price of an option contract and are calculated using a theoretical options pricing model. That same model can be used to determine the impact of each factor as it changes.

Delta: The hedge ratio

This factor answers the question of “How much will the price of the option move if the stock moves by $1?” For example, a delta of 0.30 means that the option’s price will theoretically move $0.30 for every $1 move in the price of the underlying.

You can also think of Delta as the probability that a given option will expire in-the-money (ITM). For example, a delta of 0.30 means the option has about a 30% chance of being in the money at expiration.

Another way you can think of Delta is as the number of shares of the underlying stock that the option behaves like. For example, a delta of 0.30 means that given a $1 move in the underlying, the option will gain or lose about the same amount of money as 30 shares of the stock.

Note: Remember that one option contract is the equivalent of 100 share purchase of the underlying. If you pay $0.30 per contract, your total cost for that contract would be $30 ($0.30 x 100).

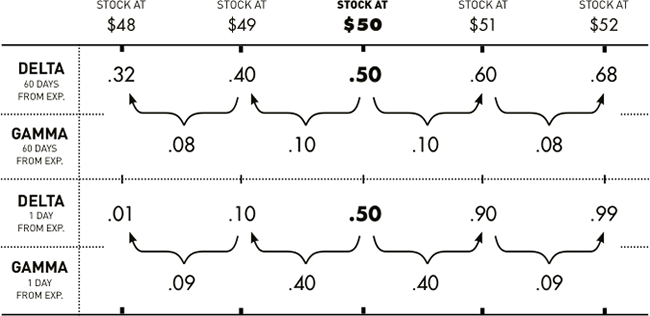

Gamma: The rate of change of Delta

Gamma is the rate that Delta will change based on a $1 change in the stock price. Think of Delta as the “speed” at which option prices change, and Gamma as the “acceleration”. The relationship between the two is as follows:

Delta is only accurate at a certain price and time

Gamma represents the difference between the two Deltas at two consecutive price levels

The figure below shows the Delta and Gamma for stock XYZ call with $50 strike price

As Delta approaches 1.00, Gamma decreases as an option gets further in the money. Essentially, the price of near-term at-the-money options will exhibit the most explosive response to price changes in the stock.

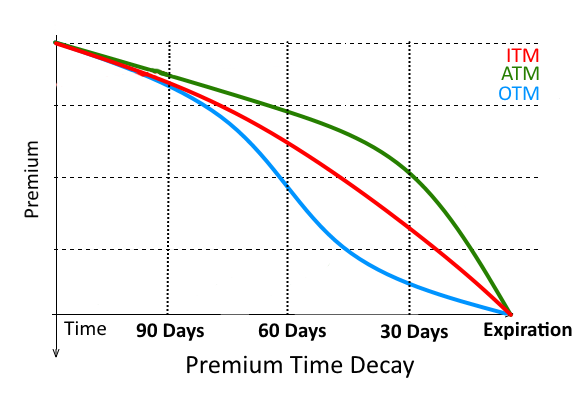

Theta: time decay

Theta represents the change in the price of an option for a one-day decrease in its time to expiration. It estimates how much value the option will lose each day if all other factors remain the same. It is the number one enemy for the option buyer.

Vega: sensitivity to volatility

Vega is the amount call/put prices will change for a corresponding one-point change in implied volatility. It is also one of the most important factors affecting the value of options. It does NOT have any effect on the intrinsic value of options – it only affects the “time value” of an option’s price. A drop in Vega will cause both calls and puts to lose value, whereas an increase in Vega will typically cause both calls and puts to gain value. That is because an increase in the volatility suggests an increased range of potential movement for the stock and vice versa.

Choosing to neglect Vega can cause you to overpay when buying options as its best to be buying options when Vega is below “normal” levels and selling options when Vega is above “normal levels”. You can learn more about the relationship between Implied Volatility (IV) and Historical Volatility (IV) by reading our previous blog post.

Rho: sensitivity to interest rates

Rho is the amount an option value will change in theory based on a 1% change in interest rates. It’s generally not a huge factor in the price of an option when trading shorter-term options. If you are trading longer-term options such as LEAPS (Long-Term Equity AnticiPations Securities), which we do not, you should spend some time looking into Rho as it has a much more significant effect.

If this was useful to you, please LIKE and share below.