If you have decided options trading is the path you would like to follow, then, without any doubt, this a concept you must understand in order to become a profitable options trader.

Below, we will explain how time decay works, its importance in making profitable trades and some examples for better understanding of the concept.

Let’s start with the basics.

WHAT IS TIME DECAY?

Time decay measures the rate of decline in the value of an option contract due to the passage of time.

As an option contract gets closer to its expiration date, time decay accelerates since there is less time to realize a profit from the trade. On the other hand, if an option has a long time until expiration, time decay will be minimal since potential option buyers will have plenty of time to realize a profit from the option contract.

The main idea to keep in mind is that options lose value as time passes and gets closer to the expiration date.

Time decay is one of the option Greeks, which is represented by the Greek sign Theta (θ). To learn about the other option Greeks, read our post about Understanding Option Greeks. Theta will always be represented by a negative number since time gets shorter as it moves closer to its expiration date and causes the extrinsic value of both puts and calls to erode (at an accelerated pace).

HOW DOES IT WORK?

As the options contract approaches its expiration date, it losses value. This loss of value starts out slowly and then begins to accelerate as the expiration date gets closer.

Generally, time decay begins gathering momentum around 60 days before the expiration date of the option contract.

Notice in the graph above how the decrease in extrinsic value accelerates rapidly as it gets closer to the expiration date. This, as previously mentioned in our blog posts, can be the number one enemy for option buyers.

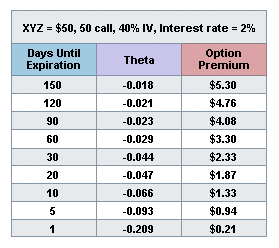

Let’s examine the table below for better understanding:

Theta (θ) shows a non-linear decrease (acceleration) as ‘Days Until Expiration’ become less and less. In other words, devaluation of the Option Premium (extrinsic value) accelerates as we get closer to its expiration date.

In this case, Theta (θ), represented by a negative number, reflects the estimated change that the option premium will lose each day if all other factors remain the same.

WHY IS IT IMPORTANT?

If you are an options buyer, you want to make sure that you buy an option contract with enough days until expiration. By doing this you will be giving the trade enough time to work and minimizing your potential value loss due to time decay.

If you are an options seller (writer), you want to estimate with the help of Theta (θ) what the rate of decay is and if it is possible to make gains from the difference in the premium received and premium paid at or before expiration.

Whether you are an options buyer, options seller or trade on both sides, time decay should always be top of mind when you are trading as it is an important variable in the pricing of options contracts.

FINAL WORDS

Before placing an options trade ask yourself:

Does this options contract have enough days until expiration for my trading idea to work out without losing significant value due to Time Decay?

By understanding Theta (θ), you will be able to easily answer this question and take this information into consideration as you pave your path to becoming a profitable options trader.

Note: A good book to get your hands on in order to better understand option pricing is Sheldon Natenberg’s Option Volatility & Pricing.

If this was useful to you, please LIKE and share below.

When you're managing a theta-rich short spread in that 30–45 DTE zone, do you prefer letting it ride to expiration, or do you scale out early to lock in profits and reduce gamma risk? Curious what balance you strike between decay capture and tail risk management.